Payroll Kinds

Set up After Tax Deduction Kinds and Staff Deductions

Step 1: Create and map After Tax Deductions kind

Navigate to JobBag menu > Kinds > Payroll category

This kind will be used when posting employee personal expenses from supplier invoices or credit card expenses.

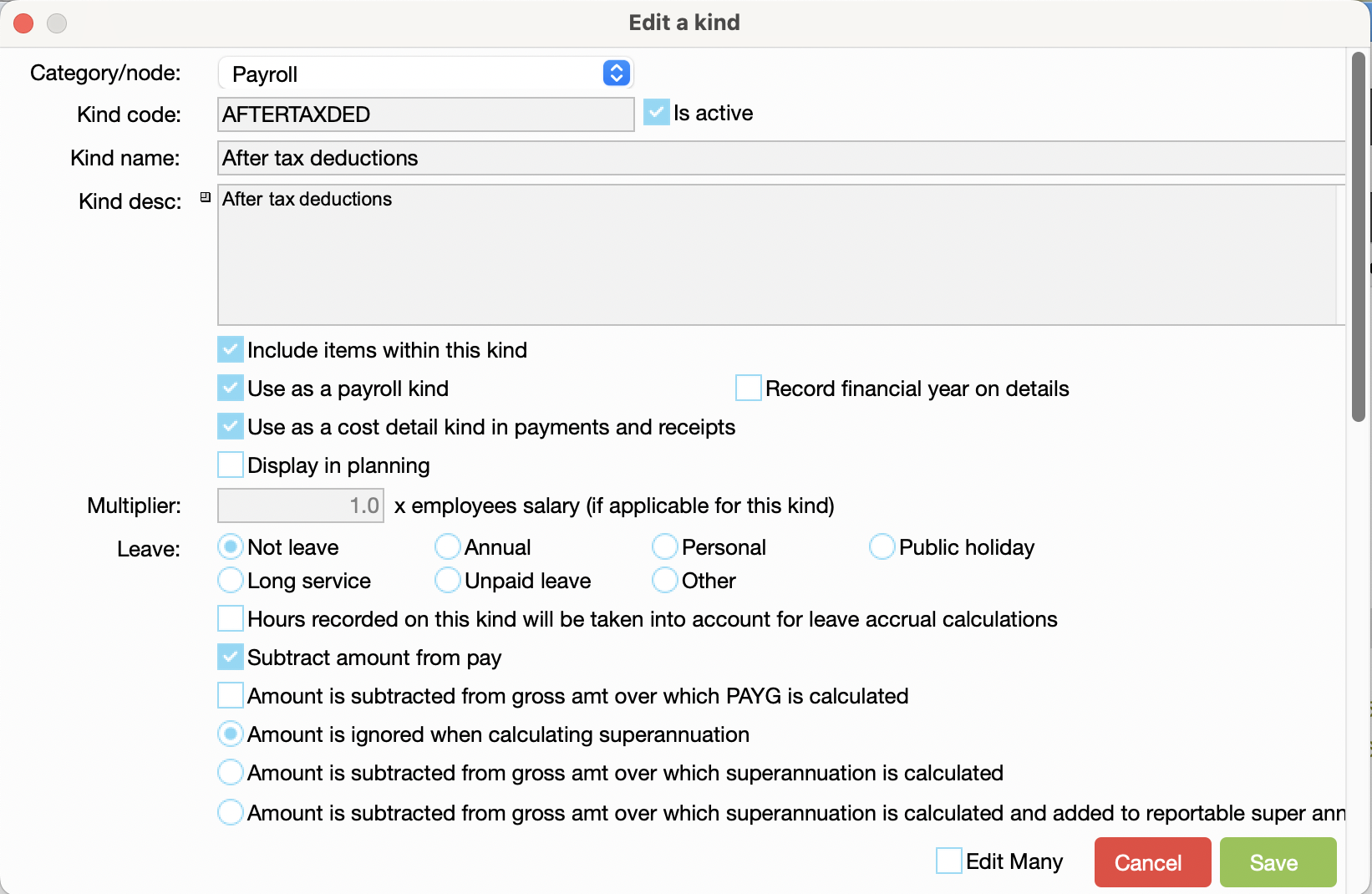

Use the screenshot below as a guide to set up the kind.

Step 2: Add item to After Tax Deduction kind

Use screenshot to guide and check set up

This item will be used to add to the employee payslip to deduct any personal expenses from employee pays

Step 3: Mapping Staff Deduction item

Only the staff deduction items needs to be mapped in payroll mapping and SBR Mapping

Payroll > Map payroll kinds > This is mapped to a balance sheet account, you can also map to an expense account.

Note: Do not map to salary and wages

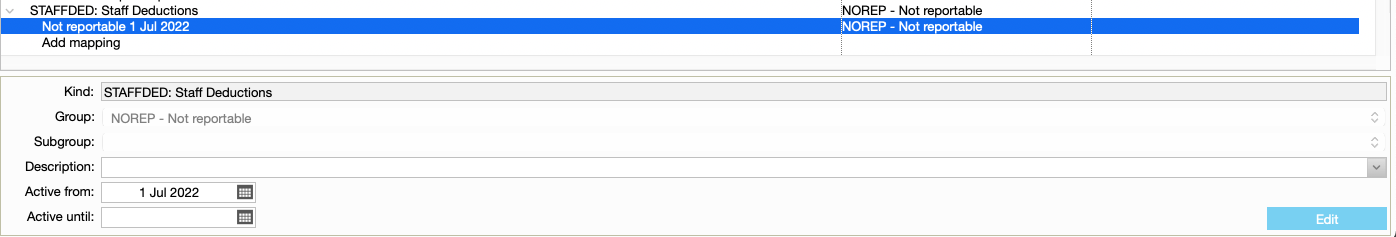

Step4: SBR Mapping items

Payroll > SBR Mapping > This is mapped to NOREP - Not reportable

Lump Sum and Termination Kinds

A number of default kinds have been set up to help process lump sum and ETP payment to employees. These can be found under the JobBag menu > Kinds > Termination and Lump Sum payments (node).

These are used when making Genuine redundancy payments, Eligible Termination Payments (ETPs), unused leave on redundancy, return to work. Below are listed some of the more frequently made payments on termination or redundancy together with the ATO Reporting Category that they are allocated to:

| Termination Payments | STP Phase 2 Reporting Category |

| Annual Leave (termination not a redundancy) | SAW>Paid Leave>U Salary and wages > Paid Leave> Unused leave termination |

| Long service accrued post 18 August 1993 (termination not a redundancy) | SAW>Paid Leave>U Salary and wages > Paid Leave> Unused leave termination |

Unused annual leave accrued before 17/08/1993 and long service accrued between 16/08/1978 and 17/08/1993 that is paid on termination (not a redundancy) |

Lump Sum A Type T |

Unused annual leave accrued before 17/08/1993 and long service accrued between 16/08/1978 and 17/08/1993 that is paid on termination (not a redundancy) |

Lump Sum B |

| Redundancy Pay (non-genuine redundancy( | ETP Taxable Component |

| Pay in lieu of notice (termination not a redundancy) | ETP Taxable Component |

| Pay out of RDO's / TOIL / Time in lieu on termination | ETP Taxable Component |

| Excess payment above tax-free portion at Lump sum D | ETP Taxable Component |

| Golden handshake / severance pay (termination not a redundancy) | ETP taxable Component |

| Pre 1 July 1983 component of termination pay (termination not a redundancy and payment does not include leave entitlements) | ETP TAX FREE component |

| Redundancy Payments | STP Phase 2 Reporting Category |

Post 18/08/1978 Unused Annual leave and Long service leave paid on redundancy (employee under age pension qualifying age) |

Lump Sum A Type R |

Post 18/08/1978 Long service leave paid on redundancy (employee over age pension qualifying age) |

SAW>Paid Leave>U Salary and wages > Paid Leave> Unused leave termination |

Long service leave that accrued prior to 16/08/1978 that is paid out on termination, no matter the cessation reason. |

Lump Sum B |

Redundancy pay ( in connection with a genuine redundancy payment and payment within the tax free limit) |

Lump Sum D |

| Pay in lieu of notice (in connection with a genuine redundancy and payment within the tax free limit) | Lump Sum D |

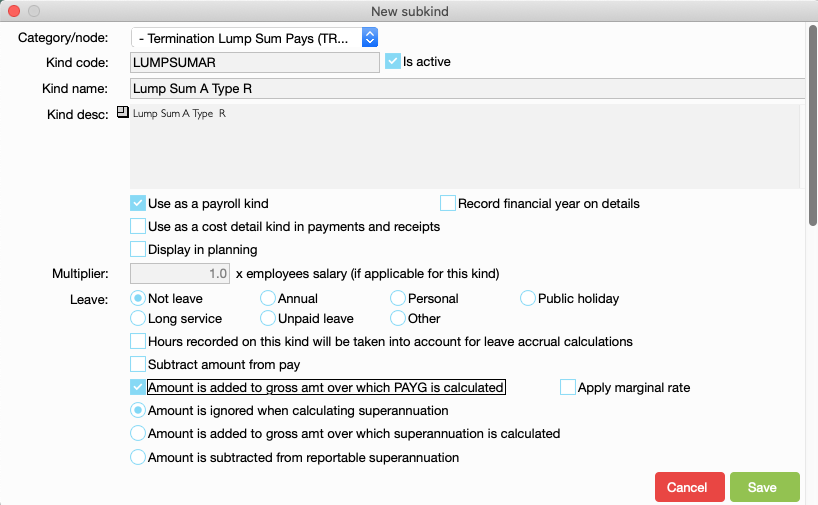

Create Sub-Kind Code for Lump Sum A Type R

R (Lump Sum A Type R) – all unused annual leave or annual leave loading, and that component of long service leave that accrued from 16/08/1978, that is paid out on termination only for genuine redundancy, invalidity or early retirement scheme reasons. Services Australia categorise these payments as Lump Sum

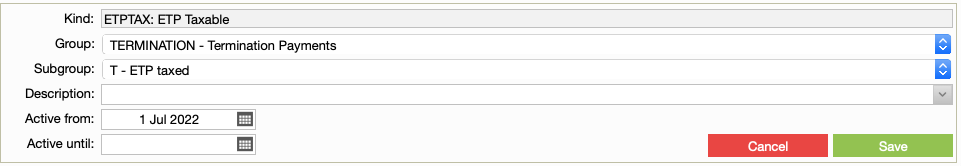

SBR Mapping - Lump Sum A Type R

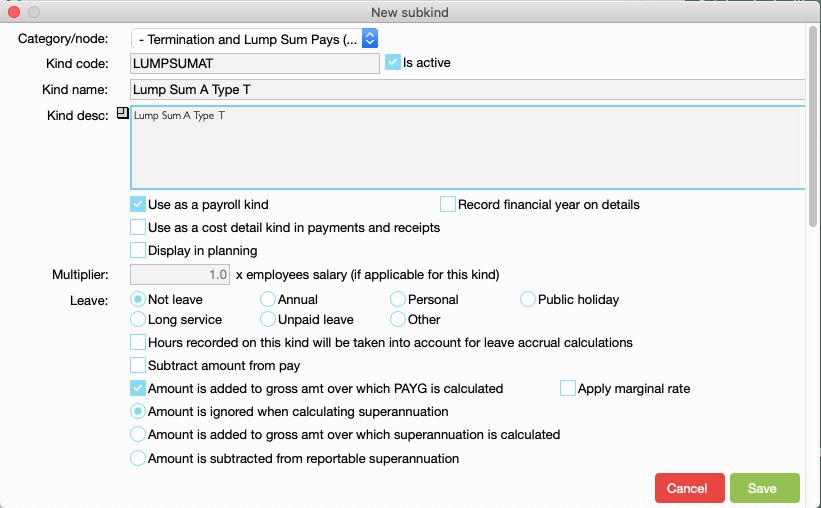

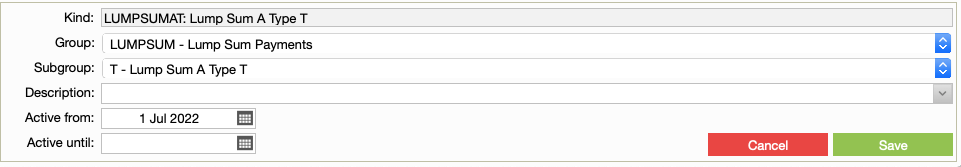

Create Sub-Kind Code for Lump Sum A Type T

T (Lump Sum A Type T) - Unused annual leave or annual leave loading that accrued before 17/08/1993, and long service leave accrued between 16/08/1978 and 17/08/1993, that is paid out on termination for normal termination (other than for a genuine redundancy, invalidity or early retirement scheme reason). Services Australia categorise these payments as Lump Sum

SBR Mapping - Lump Sum A Type T

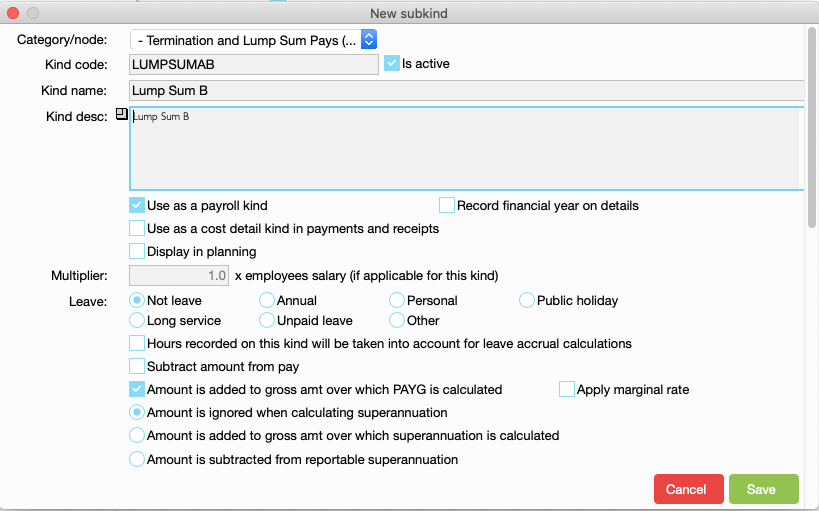

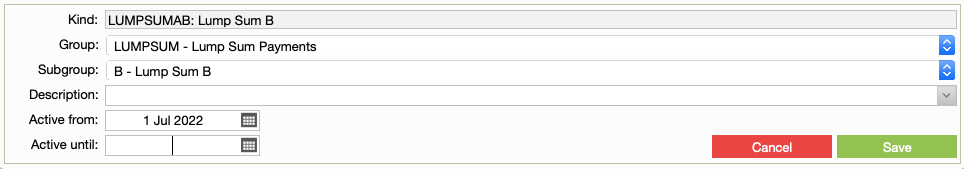

Create Sub-Kind Code for Lump Sum B

B (Lump Sum B) – long service leave that accrued prior to 16/08/1978 that is paid out on termination, no matter the cessation reason. Only 5% of this reported amount is subject to withholding. Services Australia categorise these payments as Lump Sum

SBR Mapping - Lump Sum B

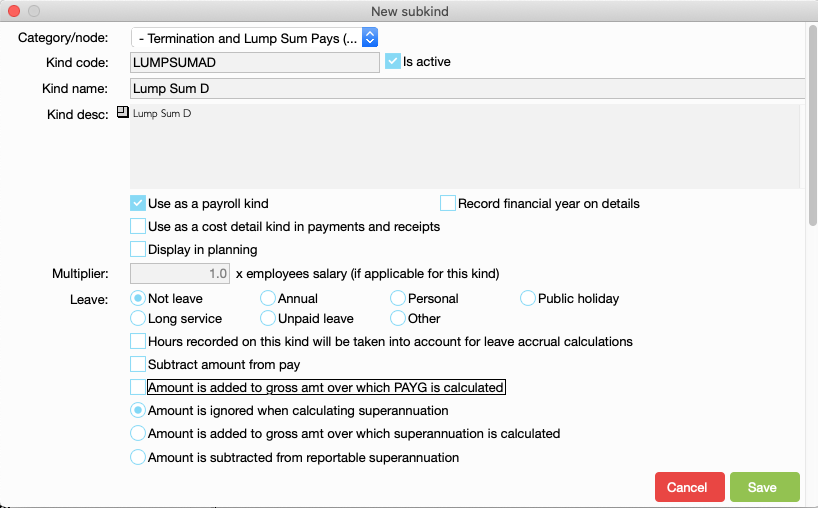

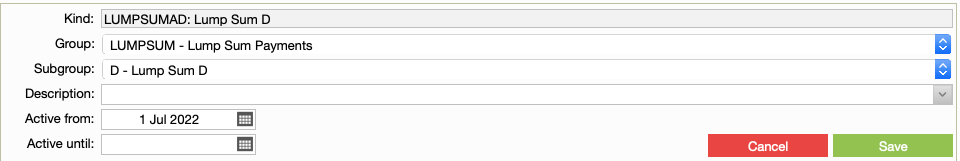

Create Sub-Kind Code for Lump Sum D

D (Lump sum D) - represents the tax-free amount of only a genuine redundancy payment or early retirement scheme payment, up to the limit, based on the payees years of service. Services Australia categorise these payments as Lump Sum

SBR Mapping - LumpSum D

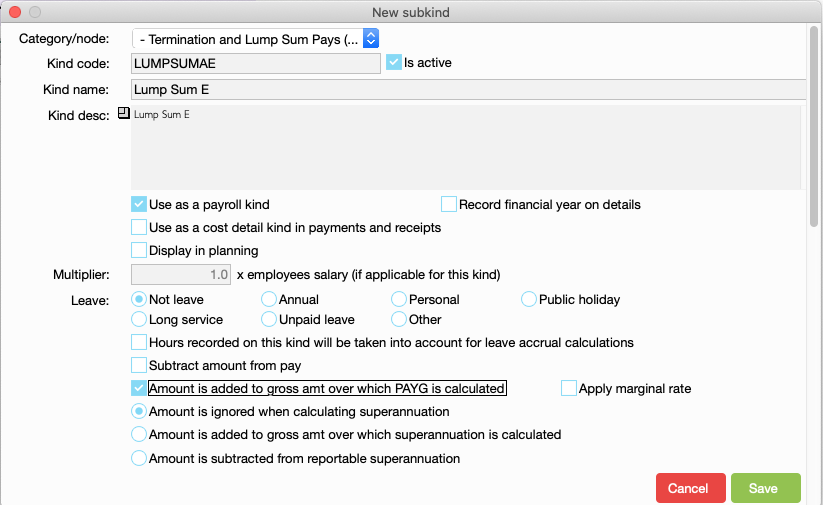

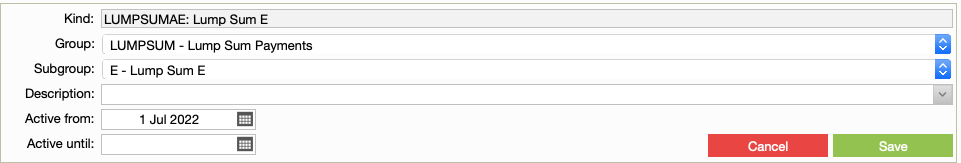

Create Sub-Kind Code for Lump Sum E

E (Lump sum E) - represents the amount for back payment of remuneration that accrued, or was payable, more than 12 months before the date of payment and is greater than the lump sum E threshold amount ($1,200). Services Australia categorise these payments as Lump Sum

SBR Mapping - Lump Sum E

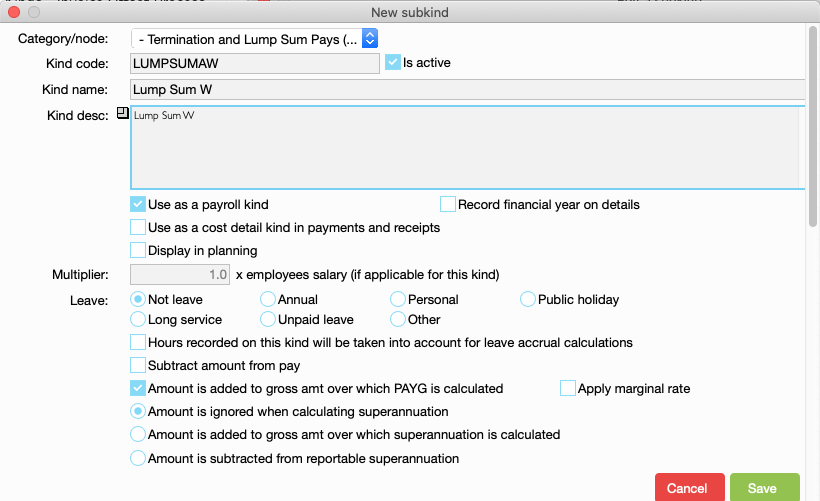

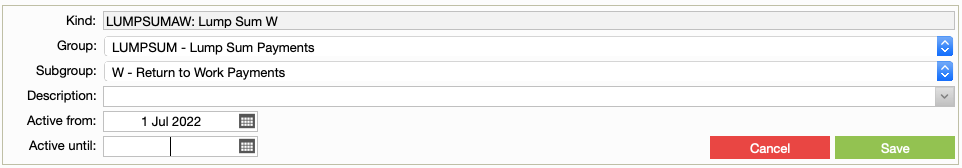

Create Sub-Kind Code for Lump Sum W ( Return to work)

W (Return to Work Payments) – NEW - A return to work amount is paid to induce a person to resume work, for example; to end industrial action or to leave another employer. It does not matter how the payments are described or paid, or by whom they are paid. This was previously reported in gross. Services Australia categorise these payments as Lump Sum .

SBR Mapping - Lump Sum W

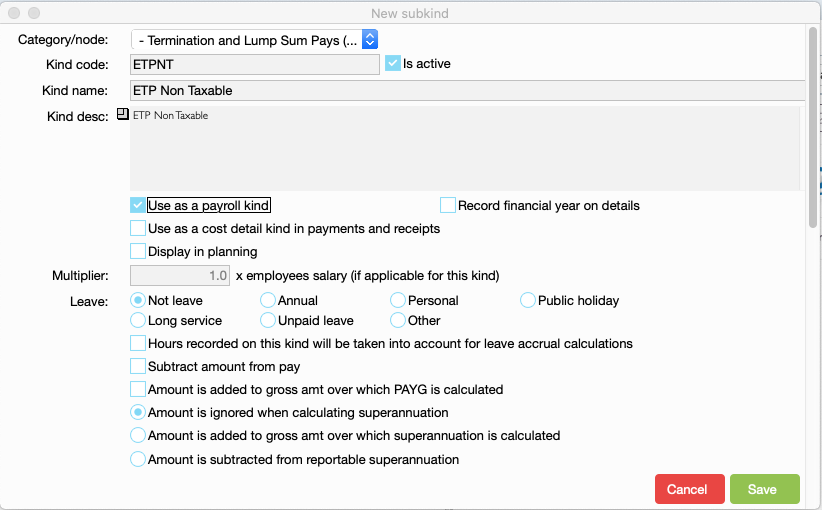

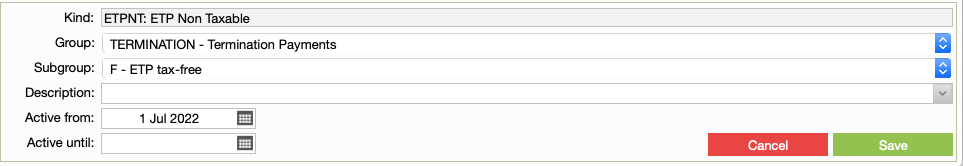

Create Sub-Kind Code for ETP Non Taxable

Only applicable to pre-July 1083 service or invalidity/death termination payments. Tax free redundancy payments are never reported as an ETP tax-free component.

SBR Mapping - ETP Non Taxable

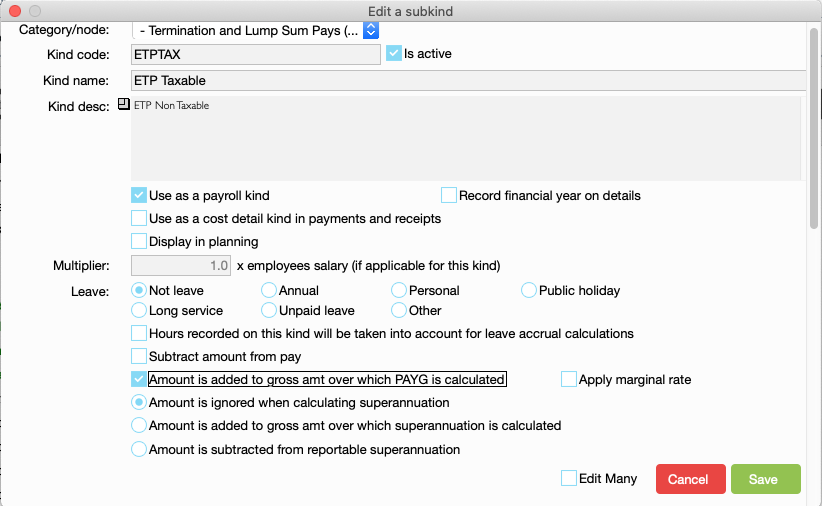

Create Sub-Kind Code for ETP Taxable

Generally includes all amounts paid to an employee on termination:

- non-genuine redundancy

- pay in lieu of notice

- pay out of RDO's / TOIL/ Time in lieu on termination

- excess payment above tax-free portion at Lump Sum D

- golden handshake / severance pay (termination not a redundancy)

SBR Mapping - ETP Taxable